Loading

Get Tpt Ez

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tpt Ez online

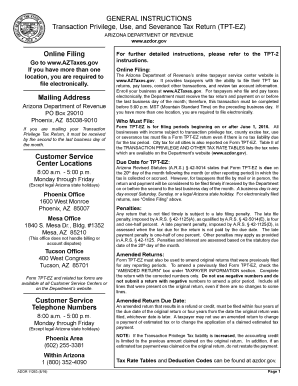

Filling out the Transaction Privilege, Use, and Severance Tax Return (TPT‑EZ) online is essential for businesses in Arizona subject to transaction privilege tax. This guide will provide clear, step-by-step instructions to help you complete the form accurately.

Follow the steps to successfully complete the Tpt Ez online.

- Click the ‘Get Form’ button to obtain the TPT‑EZ form and open it in your preferred editor.

- Provide your taxpayer information at the beginning of the form. This includes checking if you are filing an amended return, entering your business name, taxpayer identification number, and license number.

- Indicate the reporting period. Enter the period beginning and period ending dates in the format MMDDYYYY.

- Complete the summary totals section. Enter the net Arizona/county tax from Page 2, and report any state excess tax collected and excess tax accounting credit.

- Fill in the revenue details from the state and city transaction sections. This includes entering gross receipts, deductions, net taxable amounts, tax rates, and total tax calculations for both state and city transactions.

- Review the total amounts due and ensure all calculations are correct. Sign and date the form, and include your phone number.

- After completing the form, you have the option to save changes, download, print, or share the TPT‑EZ form.

Don't wait! Complete your transaction privilege tax return online today.

Related links form

TPT and Use Tax: Those individuals and businesses subject to use tax include the following: An out-of-state retailer or utility business making sales of tangible personal property to Arizona purchasers. An Arizona resident who purchases goods from an out-of-state vendor who did not collect the use tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.