Loading

Get Tot Form - Carlsbadca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TOT Form - Carlsbadca online

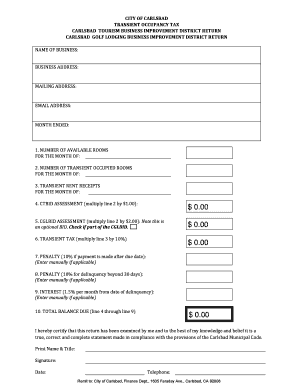

Filling out the TOT Form - Carlsbadca online provides a streamlined way to report your transient occupancy tax. This guide will assist you in completing each component of the form accurately and efficiently.

Follow the steps to successfully complete the TOT Form online.

- Click ‘Get Form’ button to obtain the form and open it in the document editor.

- Enter the name of your business in the designated field. Ensure that the name matches your official business registration.

- Provide the business address where your establishment is located. This should be the physical location and not just a mailing address.

- Fill in the mailing address if it differs from the business address. This is where any correspondence will be sent.

- Input your email address to receive confirmation and any follow-up communications. Make sure it is an active account that you check regularly.

- Select the month for which you are reporting by indicating it in the 'month ended' section.

- Enter the total number of available rooms for the reported month into line 1.

- Provide the number of transient occupied rooms for that month in line 2. This data is crucial for calculating your tax obligations.

- Document your transient rent receipts for the month in line 3. This amount will be used to determine the transient tax owed.

- Calculate the CTBID assessment by multiplying the number of transient occupied rooms (line 2) by $1.00. Enter the result in line 4.

- If applicable, calculate the CGLBID assessment by multiplying line 2 by $2.00. Check the box if you are part of the CGLBID and enter the result in line 5.

- Determine the transient tax by multiplying the amount in line 3 by 10% and record it in line 6.

- If applicable, manually enter any penalty for late payment on line 7.

- Enter any additional penalties for delinquency beyond 30 days on line 8, if necessary.

- Add any interest charges at 1.5% per month from the date of delinquency and enter that on line 9.

- Compute the total balance due by summing lines 4 through 9. Ensure this total is accurate and reflects all calculations.

- Certify the accuracy of your return by providing your printed name, title, signature, and date in the designated fields.

- Finally, provide your telephone number for any necessary follow-up inquiries.

- Once all fields are completed and verified, you can save changes to the form, download a copy, print, or share it as needed.

Complete your TOT Form online now for a smooth and efficient filing process.

Related links form

The City of San Diego taxes the occupancy of any structure or any portion of any structure....TOT and TMD Rates. Tax/AssessmentRateTOT - all lodging businesses10.50%TMD assessment - lodging businesses with 70 or more rooms2.00% 28 Mar 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.