Loading

Get Service Canada Form Sc Isp 3520

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Service Canada Form Sc Isp 3520 online

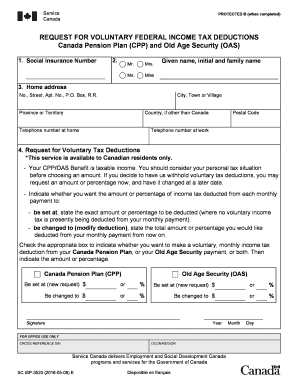

Filling out the Service Canada Form Sc Isp 3520 online can facilitate your request for voluntary federal income tax deductions from your Canada Pension Plan and Old Age Security benefits. This guide provides a clear, step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to access the Service Canada Form Sc Isp 3520 and open it in your preferred editor.

- In the first section, enter your Social Insurance Number (SIN) in the provided field. This is a mandatory field and must be completed accurately.

- Next, specify your title by selecting one of the options: Mr., Mrs., Ms., or Miss. Then, input your given name, initials, and family name in the respective fields.

- You will need to provide your home address. Fill in your address details, including street number, street name, apartment number (if applicable), city, province or territory, postal code, and telephone number at home. If you have a work telephone number, include it as well.

- In the section for requesting voluntary tax deductions, clearly indicate whether you would like to set or change an amount or percentage of tax to be deducted from your Canada Pension Plan and/or Old Age Security payments. You need to check the appropriate box for each option.

- If you choose to set a new amount or percentage, enter that amount in the designated field. If you are modifying an existing deduction, please state the desired new amount or percentage in the corresponding area.

- Finally, ensure you sign the form, which confirms your request and any deductions you wish to make. Review all the information to ensure accuracy.

- After completing the form, you can save your changes, download a copy, print it, or share it as required.

Complete your Service Canada Form Sc Isp 3520 online today to help manage your tax deductions effectively.

Related links form

The maximum employee contribution changes each year; in 2023 it is $3,754.45, or 5.95% of your salary (less a $3,500 exemption), whichever is more. For self-employed people — who pay both the employer and employee contributions — the maximum CPP contribution is $7,508.90.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.