Loading

Get 1099 Certification

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099 certification online

This guide will help you navigate the process of filling out the 1099 certification online. We will provide clear instructions for each section, ensuring you understand what information is needed and how to accurately complete the form.

Follow the steps to complete the 1099 certification efficiently.

- Click the ‘Get Form’ button to access the 1099 certification form and open it in your preferred editor.

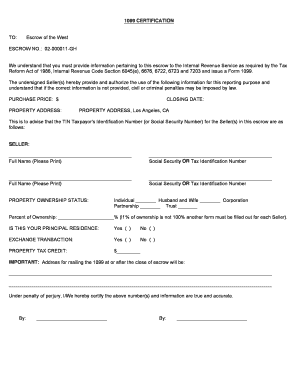

- Fill in the 'Escrow No.' field with the specified escrow number, 02-000011-GH, as referenced in the document.

- Input the 'Purchase Price' of the property in the designated field.

- Provide the complete 'Property Address' where the transaction is taking place, including the city and state.

- Enter the 'Closing Date' of the transaction in the appropriate section.

- List the names and social security or tax identification numbers of the Seller(s) in the sections provided, ensuring accuracy to avoid penalties.

- Indicate the 'Property Ownership Status' by checking the appropriate box, such as 'Individual', 'Partnership', 'Husband and Wife', 'Trust', or 'Corporation.'

- If ownership is shared, specify the 'Percent of Ownership.' If not 100%, another form must be completed for additional sellers.

- Respond to whether this property is your principal residence by marking 'Yes' or 'No.'

- State whether it is an 'Exchange Transaction' by selecting 'Yes' or 'No.'

- If applicable, enter the amount for the 'Property Tax Credit.'

- Provide the mailing address for sending the 1099 after the close of escrow.

- Read the certification statement and ensure that all provided information is accurate, signing by typing your names as the undersigned sellers.

- Once all sections are completed, save your changes, download, print, or share the form as needed.

Complete your 1099 certification online today to ensure accurate reporting and compliance.

Related links form

Since the IRS considers any 1099 payment as taxable income, you are required to report your 1099 payment on your tax return. For example, if you earned less than $600 as an independent contractor, the payer does not have to send you a 1099-MISC, but you still have to report the amount as self-employment income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.