Loading

Get Ttb F 5600.35 - Ttb

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TTB F 5600.35 - Ttb online

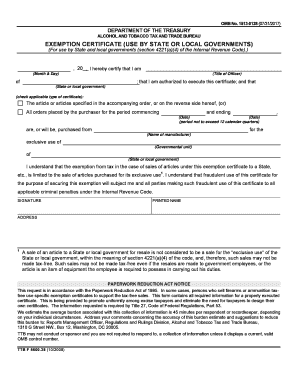

The TTB F 5600.35 form is used by state and local governments to certify their exemption from taxes on specific purchases. This guide will walk you through the process of filling out the form online, providing clear instructions for each section.

Follow the steps to complete the TTB F 5600.35 form online.

- Click the 'Get Form' button to access the TTB F 5600.35 form, which will open in the editor.

- Enter the date of certification in the 'Month & Day' fields at the top of the form.

- Complete the 'Title of Officer' field with your official title.

- Specify the state or local government that you represent in the corresponding field.

- Select the applicable type of certificate by checking the correct option regarding the articles specified in the accompanying order.

- Indicate the period for which the exemption is valid, entering both the start and end dates in the provided fields.

- Fill in the name of the manufacturer from whom the articles will be purchased.

- Specify the governmental unit associated with this exemption in the designated field.

- Review the certification statement, ensuring you understand the limitations regarding the exemption.

- Provide your signature and printed name at the end of the form.

- Complete the address section to provide your contact information.

- Once all fields are completed, save your changes, download the form, print it, or share it as needed.

Start filling out your TTB F 5600.35 form online today to ensure timely processing.

Most forms must be submitted to the National Revenue Center, 550 Main Street, Suite 8002, Cincinnati, Ohio 45202, complete with signature and date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.