Loading

Get 42a801(d)(4-08).pmd - Revenue Ky

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 42A801(D)(4-08).pmd - Revenue Ky online

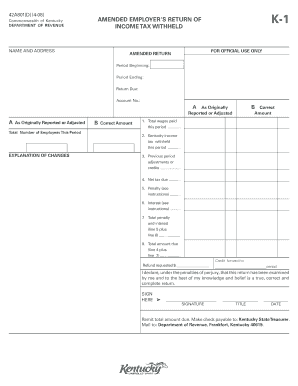

Filling out the 42A801(D)(4-08).pmd form is essential for reporting income tax withheld in Kentucky. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the form online.

- Press the 'Get Form' button to access the form and open it in your preferred editor.

- In the 'Name and Address' section, provide the official name and mailing address of the employer. This information should match what is on file with the Department of Revenue.

- Locate the 'K-1' section and fill in the account number associated with your business as well as the period beginning and ending dates relevant to this income tax return.

- In the 'Amended Return' section, indicate whether this form is an amended return or a new submission by marking the appropriate checkbox.

- In the 'Total Number of Employees This Period' field, input the accurate number of employees that were active during the reporting period.

- Fill out the 'Explanation of Changes' section detailing any necessary corrections or updates being made compared to previous filings.

- In the fields provided, enter the correct amounts for total wages paid this period, Kentucky income tax withheld this period, and any previous period adjustments or credits.

- Calculate the net tax due and include any penalties or interest as indicated on the form, adding up the total amount due. If applicable, indicate the amount of refund requested or any credit forwarded to the next reporting period.

- Sign the form in the designated area, providing your signature, title, and the date of completion to confirm the accuracy of the information submitted.

- Once all fields are complete, review the document for accuracy and save changes. You can then download, print, or share the form as needed.

Complete your Revenue Ky forms online today for an efficient filing experience.

Related links form

Kentucky's individual income tax law is based on the Internal Revenue Code in effect as of December 31, 2021. The tax rate is five (5) percent and allows itemized deductions and certain income reducing deductions as defined in KRS 141.019.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.