Loading

Get Determination Of Residency Status Entering Canada - Cra-arc Gc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Determination Of Residency Status Entering Canada - Cra-arc Gc online

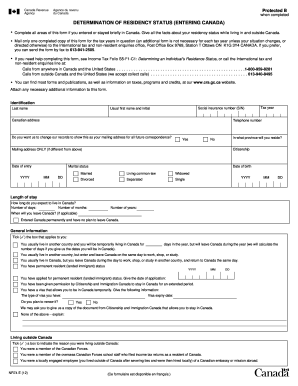

Filling out the Determination Of Residency Status Entering Canada form is essential for individuals who have entered or briefly stayed in Canada. This guide provides clear, step-by-step instructions to help you navigate the form accurately and efficiently.

Follow the steps to effectively complete the form online.

- Press the ‘Get Form’ button to receive the form and open it for editing. Ensure that you have a stable internet connection before you begin.

- Begin by completing the identification section. Provide your last name, social insurance number, usual first name and initial, Canadian address, telephone number, and indicate if you want to change your mailing address for future correspondence.

- Fill in the date of entry, date of birth, tax year, and your marital status by selecting the appropriate option.

- In the length of stay section, indicate how long you expect to live in Canada by providing the number of days, months, and years. If you plan to leave Canada, include the date.

- In the general information section, select the box that applies to your situation regarding your usual residence and temporary stay in Canada.

- Tick the relevant boxes under ‘Living outside Canada’ to specify your reasons for residing outside Canada and any relevant residency details.

- Provide a statement of your residency by indicating ties you will have in Canada, such as owning a dwelling, having family members with you, or obtaining medical coverage.

- Describe your ties to another country, including any residential ties and possessions you may have, and specify relationships that impact your residency status.

- Complete the certification section by printing your name, signing, and dating the form to certify that all information is correct and complete.

- Once you have finished filling out the form, save your changes. You can then download, print, or share the completed document as needed.

Start completing your Determination Of Residency Status Entering Canada form online today!

Related links form

You become a resident of Canada for income tax purposes when you have enough residential ties in Canada. You usually establish residential ties on the day you arrive in Canada. Significant residential ties to Canada include: a home you own or lease in Canada.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.