Loading

Get (sfs) Tax Return - Maine

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the (SFS) Tax Return - Maine online

Navigating tax documents can be challenging. This guide provides clear, step-by-step instructions on how to successfully complete the (SFS) Tax Return for Maine online, ensuring you have the support you need throughout the process.

Follow the steps to complete your (SFS) Tax Return online.

- Press the ‘Get Form’ button to access the (SFS) Tax Return document and open it in your preferred editor.

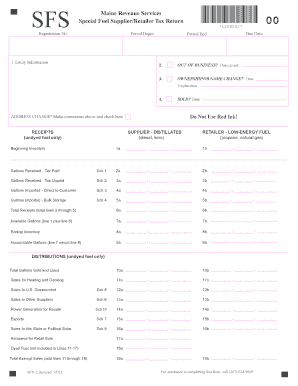

- Enter your entity information including your registration number, beginning and ending periods, and the due date for submission.

- Indicate whether you are out of business, and if so, provide the date you closed. Make sure to include any necessary explanations.

- If applicable, identify any ownership or name changes with the relevant dates and details.

- Fill in your address changes if necessary, ensuring to check the appropriate box provided.

- Report your receipts in Section 1, which includes details about gallons received - tax paid and tax unpaid. Make sure to supply accurate figures across all required fields.

- Continue to list gallons imported to customers and for bulk storage under the appropriate sections, ensuring each entry is clearly marked.

- Calculate your total receipts by summing the relevant lines, providing a clear figure for total gallons sold and used.

- Complete the tax computation section, calculating the taxable gallons and entering the applicable rates for taxes due.

- If there are any credits from the prior period, enter them in the specified field to adjust your total due.

- Review your entries carefully, ensuring that all information is correct before finalizing your forms.

- Finally, save your changes, and download the completed form. You may also print or share it as necessary.

Complete your (SFS) Tax Return online today to ensure timely submission and compliance.

Related links form

Anyone who is a resident of Maine for any part of the tax year, and has taxable Maine-source income, must file a Maine return. Anyone who is not a resident of Maine, but performs personal services in Maine for more than 12 days and earns more than $3,000 of income from all Maine sources, must file a Maine return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.