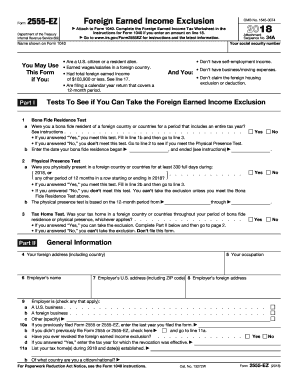

Get IRS 2555-EZ 2018-2024

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Us tax form 2555 ez online

How to fill out and sign Exclusion online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When people aren?t connected to document managing and law procedures, filling in IRS documents can be extremely difficult. We recognize the value of correctly completing documents. Our online software proposes the way to make the mechanism of processing IRS documents as easy as possible. Follow these guidelines to quickly and properly complete IRS 2555-EZ.

How you can complete the IRS 2555-EZ on the Internet:

-

Click the button Get Form to open it and start modifying.

-

Fill out all needed fields in the document making use of our advantageous PDF editor. Turn the Wizard Tool on to finish the process even simpler.

-

Ensure the correctness of added details.

-

Add the date of finishing IRS 2555-EZ. Utilize the Sign Tool to make an individual signature for the record legalization.

-

Complete modifying by clicking on Done.

-

Send this file straight to the IRS in the most convenient way for you: via electronic mail, making use of virtual fax or postal service.

-

It is possible to print it out on paper when a copy is needed and download or save it to the favored cloud storage.

Utilizing our platform will make skilled filling IRS 2555-EZ a reality. make everything for your comfortable and simple work.

How to edit 2555 ez form: customize forms online

Finishing papers is easy with smart online instruments. Eliminate paperwork with easily downloadable 2555 ez form templates you can edit online and print out.

Preparing documents and documents should be more reachable, whether it is a regular element of one’s occupation or occasional work. When a person must file a 2555 ez form, studying regulations and guides on how to complete a form correctly and what it should include might take a lot of time and effort. Nevertheless, if you find the right 2555 ez form template, finishing a document will stop being a struggle with a smart editor at hand.

Discover a broader variety of features you can add to your document flow routine. No need to print out, fill in, and annotate forms manually. With a smart editing platform, all of the essential document processing features will always be at hand. If you want to make your work process with 2555 ez form forms more efficient, find the template in the catalog, click on it, and see a simpler way to fill it in.

- If you need to add text in a random area of the form or insert a text field, use the Text and Text field tools and expand the text in the form as much as you want.

- Utilize the Highlight tool to stress the important parts of the form. If you need to cover or remove some text parts, utilize the Blackout or Erase instruments.

- Customize the form by adding default graphic elements to it. Use the Circle, Check, and Cross instruments to add these elements to the forms, if possible.

- If you need additional annotations, use the Sticky note tool and put as many notes on the forms page as required.

- If the form needs your initials or date, the editor has instruments for that too. Reduce the risk of errors by using the Initials and Date tools.

- It is also easy to add custom graphic elements to the form. Use the Arrow, Line, and Draw instruments to customize the document.

The more instruments you are familiar with, the easier it is to work with 2555 ez form. Try the solution that offers everything essential to find and edit forms in one tab of your browser and forget about manual paperwork.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing ez

Simplify the entire irs form 2555 ez preparation process with this easy-to-understand video backed up by superior experience. Discover how to spend less time on better template completion on the web.

Ez irs 2016 FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to 2555 or 2555 ez

- 2555

- income exclusion

- 2016 ez irs

- 2018 2555

- 2555 ez

- hud 52681

- 2555 form

- irs 2555ez

- foreign earned income exclusion

- hud 4010

- 2555 form 2016

- irs 2017 foreign

- form 2555 instructions

- ez 2016

- 2555ez

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.