Loading

Get Form 80-107-15-8-1-000 (rev - Dor Ms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 80-107-15-8-1-000 (Rev - Dor Ms) online

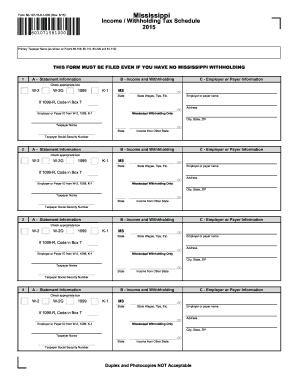

Filling out Form 80-107-15-8-1-000 (Rev - Dor Ms) can be an essential step in managing your income and withholding tax obligations. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully fill out the form online.

- Click 'Get Form' button to obtain the form and open it for editing.

- Begin by entering the primary taxpayer name as it appears on related forms such as 80-105, 80-110, 80-205, and 81-110. Ensure that the spelling is accurate to avoid delays in processing.

- Complete the 'Statement Information' section. This may include various fields that detail the type of withholding and income.

- In the 'Income and Withholding' section, specify the total amount of state wages, tips, etc., in the designated field. If you received income from another state, report that as well.

- Provide the employer or payer information, including their name and identification details from the respective forms. This is critical for your tax records.

- Verify that all personal information, including your social security number, is entered correctly to avoid issues with tax processing.

- Once all sections are filled in, review your entries for accuracy. After verification, you can save your changes, download a copy, print, or share the completed form.

Complete your documents online and streamline your tax filing process today.

Income Tax Brackets The standard deduction in Mississippi is $2,300 for single filers and married individuals filing separately, $4,600 for married individuals filing jointly and $3,400 for heads of household. If itemized deductions are less than the standard deduction, taxpayers receive the standard deduction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.