Loading

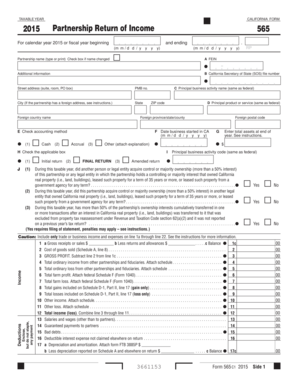

Get Get 565 Booklet To See The Instructions For The 565 Form Taxable Year California Form Partnership

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Get 565 booklet to see the instructions for the 565 form taxable year california form partnership online

The Get 565 booklet provides essential instructions for completing the 565 form for partnerships in California. Follow this guide to navigate the process effectively, ensuring all required fields are accurately filled out and submitted on time.

Follow the steps to complete the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the partnership name. If the partnership name has changed, check the appropriate box provided on the form.

- Enter the partnership's Federal Employer Identification Number (FEIN) in the designated section.

- Provide additional information such as the California Secretary of State file number and the business address, including city, state, and ZIP code.

- Indicate the principal business activity name and the principal product or service provided by the partnership.

- Select the accounting method used by the partnership by checking the appropriate box: cash, accrual, or other (with an explanation attached).

- Mark the applicable box indicating if this is an initial return, final return, or amended return.

- Input the total assets at the end of the year.

- Complete income and deductions sections by entering relevant figures into the corresponding fields. Follow all directions provided in the instructions carefully.

- After completing the form, review all information for accuracy. Save changes as needed.

- Download, print, or share the form as required, ensuring all backup documentation is attached.

Start filling out your forms online today for a smooth submission process.

Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. The LLC is organized in California. The LLC is organized in another state or foreign country, but registered with the California SOS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.