Loading

Get Credit (see Instr - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Credit (see Instr - Irs online

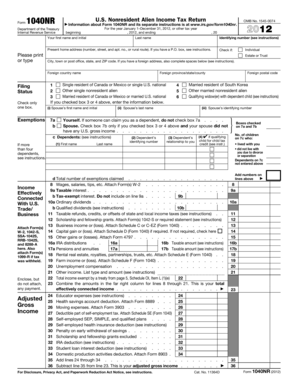

Filling out the Credit (see Instr - Irs is essential for ensuring accurate reporting of income and taxes as a nonresident alien. This guide provides a step-by-step approach to help users navigate the form effectively and with confidence.

Follow the steps to successfully complete your Credit (see Instr - Irs.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will give you access to the Credit (see Instr - Irs form to begin completing it online.

- Provide your personal information in the designated fields, including your first name, last name, and current address. If you have a foreign address, ensure to complete all required fields based on the instructions.

- Indicate your filing status by checking only one box that applies to your situation. This is crucial as it affects how your income is classified and taxed.

- List any dependents you are claiming. Provide their names, identifying numbers, and relationship to you, adhering to the guidelines specified in the instructions.

- Enter all applicable income information you have earned that is connected with U.S. trade or business. This includes wages, salaries, tips, and other sources as identified in the form.

- Complete the sections for deductions and credits carefully. These fields will allow you to adjust your income for eligible deductions, thereby potentially reducing your taxable income.

- Make sure to check your calculations for any taxes owed or refunds due. It is vital to ensure that all amounts are added and subtracted correctly to avoid discrepancies.

- Review the completed form for accuracy. After confirming that all information is filled in correctly, you can choose to save changes, download, print, or share the form as required.

Complete your Credit (see Instr - Irs form online now to ensure timely and accurate filing of your taxes.

To qualify for the full payment, you must make less than $75,000 per year ($150,000 for a married couple filing jointly) or less than $112,500 if you're the head of household (typically single parents). Even if you have no income, you're eligible to receive a stimulus check.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.