Loading

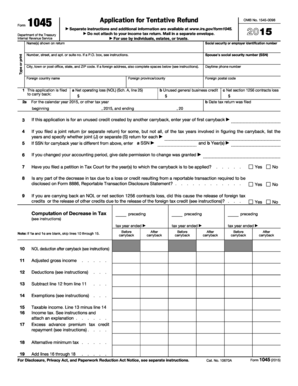

Get 2015 Form 1045. Application For Tentative Refund - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2015 Form 1045. Application for tentative refund - IRS online

This guide provides comprehensive and user-friendly instructions on completing the 2015 Form 1045, Application for Tentative Refund. Designed for individuals, estates, and trusts, this form allows you to apply for a refund based on net operating losses or other credits. Follow the steps below to ensure a smooth completion of the form online.

Follow the steps to effectively complete the application.

- Use the ‘Get Form’ button to obtain the form and have it open in your selected editor.

- Begin by providing your name as it appears on your tax return, along with your social security number or employer identification number.

- Fill in your current address, including the street address, city, state, and ZIP code. If you have a foreign address, ensure to complete the additional fields provided for that purpose.

- Indicate the type of application you are submitting in section 1, selecting the appropriate option such as net operating loss, unused general business credit, or net section 1256 contracts loss.

- In section 2, provide the relevant tax year information. This includes specifying whether the application pertains to the calendar year 2015 or another tax year.

- If applicable, complete section 3 by entering the year of the first carryback for an unused credit.

- Respond to any additional questions regarding your tax filing history in sections 4 to 9, which may require information related to joint returns, accounting periods, and Tax Court petitions.

- Proceed to the computation of decrease in tax in lines 10 to 33. These lines mandate calculations regarding your adjusted gross income, deductions, exemptions, and other variables to determine your taxable income and overall tax.

- Sign the application in the designated area, ensuring to include the date. If applicable, your spouse should also sign and date the form.

- Ensure to include the preparer's information if a paid preparer assisted you. This includes the name, signature, and contact details.

- Review the entire application for completeness and accuracy before finalizing.

- At the final step, save the changes made to the form, and choose to download, print, or share the completed application for your records.

Complete your documents online with confidence and efficiency today!

Related links form

Attach to Form 1045 a copy of Form 6781 and Schedule D (Form 1040 or 1040-SR) for the year of the net section 1256 contracts loss and an amended Form 6781 and an amended Schedule D (Form 1040) for each carryback year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.