Loading

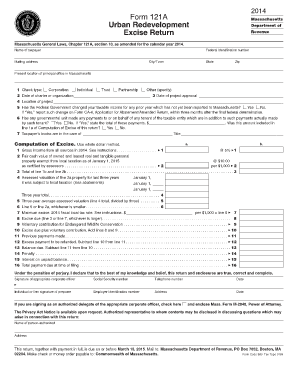

Get 2014 Form 121a Urban Redevelopment Excise Return Massachusetts Department Of Revenue Massachusetts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 Form 121A Urban Redevelopment Excise Return Massachusetts online

Filling out the 2014 Form 121A Urban Redevelopment Excise Return is an essential step for taxpayers involved in urban redevelopment in Massachusetts. This guide will provide you with clear, user-friendly instructions to successfully complete the form online.

Follow the steps to accurately complete your excise return.

- Press the 'Get Form' button to obtain the form and open it in your editor.

- Begin by entering your name as the taxpayer and provide your Federal Identification Number. Make sure to accurately input your mailing address, city or town, state, and zip code.

- Indicate the present location of your principal office in Massachusetts. Check the box that corresponds to your entity type: Corporation, Individual, Trust, Partnership, or Other.

- For the date of charter or organization, input the appropriate date. Similarly, provide the date of project approval and the specific location of the project.

- Answer whether the Federal Government has changed your taxable income for any prior year that has not been reported to Massachusetts. If 'Yes', report this change using Form CA-6.

- Indicate if any governmental unit has made additional payments to a tenant of the taxable entity. If applicable, state the total of these payments and confirm whether this amount was included in line 1a.

- Specify who is responsible for the taxpayer’s books, including their title.

- Proceed to the computation of excise section. Follow the provided instructions to fill out lines related to gross income, property values, and excise calculations.

- Fill in details such as previous payments made, any excess payment for refund, and the balance due. Be precise with calculations to ensure accuracy.

- Under the penalties of perjury, sign the form, providing the necessary details like Social Security number, telephone number, and date of signing.

- If applicable, include the signature of a preparer and check the box if signing as an authorized delegate. Provide any required additional documentation.

- After reviewing all information for accuracy, proceed to save your changes, and you may optionally download, print, or share the completed form.

Complete your filing online today to ensure compliance with Massachusetts tax regulations.

Examples of e-vouchers include admission tickets for events, software licence codes, gaming codes and prepaid mobile telephone cards.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.