Loading

Get Irs 8569 2006-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8569 online

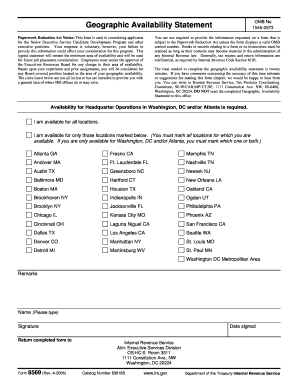

The IRS 8569 form is a vital document for applicants seeking positions in the Senior Executive Service Candidate Development Program and other executive roles. This guide will provide a step-by-step approach to completing this form online to ensure a smooth and efficient application process.

Follow the steps to successfully complete the IRS 8569 form online.

- Press the ‘Get Form’ button to obtain the IRS 8569 form and open it in the editor.

- Carefully read the instructions provided to understand the purpose of the form and the importance of your responses for the applicant consideration.

- In the section regarding geographic availability, specify your availability for headquarters operations, marking either 'I am available for all locations' or 'I am available for only those locations marked below'.

- If you are only available for certain locations, review the list provided and mark all the respective locations where you are available.

- In the 'Remarks' section, you may add any additional comments or clarifications regarding your availability.

- Fill in your name in the 'Name' field by typing it clearly.

- Date the form by entering the current date in the 'Date signed' section.

- Complete the process by saving your changes. You can download, print, or share the completed form as needed.

Start filling out your IRS 8569 form online today for your career advancement!

To fill out Form 3911, begin by providing your name, address, and Social Security number clearly. Next, specify the type of payment you are inquiring about, along with the amount you expected to receive. Take care to follow the instructions carefully, as identifying information is vital for accurate processing, paying attention to clarifications found in IRS 8569.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.