Loading

Get Brd Full Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Brd Full Form online

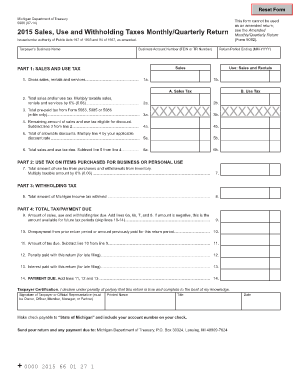

Filling out the Brd Full Form is a critical process for reporting sales, use, and withholding taxes. This guide provides you with clear, step-by-step instructions on how to accurately complete this form online, ensuring that you meet all necessary requirements.

Follow the steps to complete the Brd Full Form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the appropriate editor.

- Enter the taxpayer’s business name in the designated field.

- Provide the business account number, either a Federal Employer Identification Number (FEIN) or a TR Number, in the specified area.

- For Part 1, Sales and Use Tax, enter your gross sales, rentals, and services for line 1a, ensuring to include all sales made during the reporting period.

- Specify the return period ending date in the MM-YYYY format.

- Complete lines 2a and 2b by calculating the total sales tax and total use tax respectively, which involves multiplying the taxable sales by the applicable tax rate.

- For line 5, calculate the total of allowable discounts based on the guidelines for your filing frequency.

- In Part 2, complete line 7 by calculating the total amount of use tax from purchases and withdrawals from inventory, using the proper percentage.

- In Part 3, withholding tax, fill in line 8 with the total amount of Michigan income tax withheld.

- In Part 4, add the amounts from lines 6a, 6b, 7, and 8 for line 9 to determine the total tax/payment due.

- Continue filling out lines 10 through 14 as applicable based on any overpayments or penalties.

- Finally, sign and date the form, then save changes, download, print, or share the completed form as needed.

Complete your Brd Full Form online today to ensure compliance and avoid penalties.

The BRD contains more details and more specifications and deadlines to be met along the way and at the end of the project. Put simply, RFx documents are used to identify which vendors your organization wants to partner with. Then, BRDs outline the goals and expectations you have for the vendor you ultimately select.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.