Loading

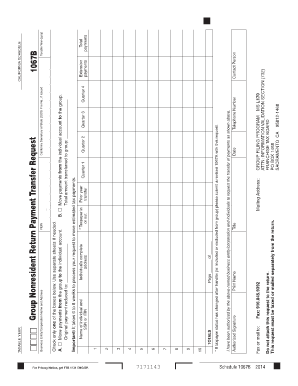

Get Schedule 1067-b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule 1067-B online

This guide provides a clear and supportive walkthrough for users filling out the Schedule 1067-B online. Understanding each component of the form will help ensure a smooth submission process.

Follow the steps to complete the Schedule 1067-B form online

- Press the ‘Get Form’ button to obtain the Schedule 1067-B form and open it for editing.

- Enter the California Secretary of State (SOS) file number if it has been issued, along with the Federal Employer Identification Number (FEIN).

- Fill in the individual’s complete address. This ensures accurate identification and correspondence.

- Indicate whether the taxpayer is in or out of the group by checking the appropriate box.

- Complete the section for prior year transfers, detailing payments for each quarter (1 through 4).

- Provide the name and other identifying information for the individual, including their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Choose whether to move payments from the group to the individual account or vice versa by checking the correct box. If transferring, detail the original payment and the total amount transferred.

- Include the business entity or corporation name and address responsible for the request.

- Provide the authorized individual's printed name, title, and their contact telephone number.

- Finally, the authorized individual must sign and date the form. Ensure that the request is faxed or mailed separately from any tax return, as combining them is not permitted.

Complete your Schedule 1067-B online today to ensure timely processing of your payment transfer requests.

Form FTB 3864 is to be used by S corporations, partnerships, and limited liability companies (LLCs). The term “business entity” refers to any one of these entities, as appropriate. The term “individual” refers to the nonresident share- holder, partner, or member.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.