Loading

Get Adjustment Form 11a Wc - Dol Nebraska

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ADJUSTMENT FORM 11A WC - Dol Nebraska online

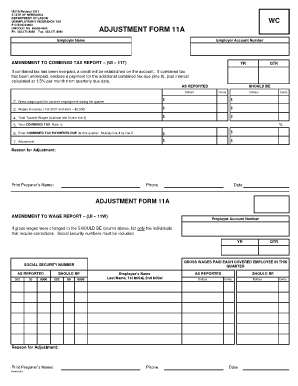

Filling out the Adjustment Form 11A WC for the state of Nebraska can be a straightforward process when approached methodically. This guide will walk you through each component of the form to ensure accurate completion.

Follow the steps to successfully complete your form online.

- Select the ‘Get Form’ button to obtain the Adjustment Form 11A WC and open it in your preferred editor.

- Begin by providing the employer name in the specified field. This identifies the company or organization submitting the form.

- Next, enter the employer account number to associate your submission with the correct tax account.

- Indicate the year and quarter for which you are making an amendment to the combined tax report.

- In the As Reported column, fill out the gross wages paid for covered employment during the quarter. Ensure figures are accurate as these will affect your tax calculations.

- Next, provide the wages in excess of the specified threshold. For years 2007 and after, this value is set at $9,000.

- Calculate the total taxable wages by subtracting the excess wages (step 6) from the gross wages (step 5). Input this value in the corresponding field.

- Identify your combined tax rate and record it in the appropriate area.

- To determine the combined tax payments due for the quarter, multiply the total taxable wages (step 7) by the combined tax rate (step 8).

- If applicable, specify the adjustment amount required in the adjustment field and provide the reason for the adjustment.

- Finally, print the preparer's name, phone number, and the date of completion. Ensure all information is clearly recorded.

Complete the Adjustment Form 11A WC online today to ensure compliance with Nebraska's unemployment insurance tax requirements.

What is the employer FICA rate for 2023? The employer FICA rate is 7.65% in 2023. Employees pay an additional 7.65% FICA tax, and self-employed workers pay the full 15.3%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.