Loading

Get Do Not Include Vacation Pay Or Earned Wages

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the DO NOT Include Vacation Pay Or Earned Wages online

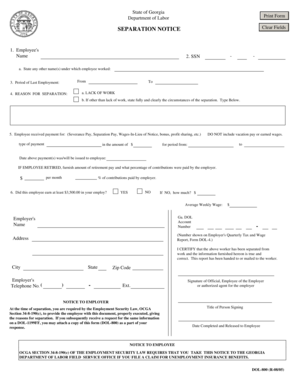

This guide provides a clear and structured approach to completing the DO NOT Include Vacation Pay Or Earned Wages form. Following these steps will help ensure that you fill out the document accurately and efficiently, facilitating the separation notice process.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to access the necessary document and open it in the editor.

- Enter the employee's name as it appears on your records. If there are any other names the employee has worked under, be sure to mention those.

- Fill in the employee's Social Security Number (SSN), making sure to check for correctness.

- Provide the period of the employee's last employment by indicating the start and end dates.

- For the reason for separation, if it was due to ‘LACK OF WORK,’ check the appropriate box. If the reason is different, describe it clearly in the space provided.

- If the employee received any type of payment such as severance pay or separation pay, specify the type of payment and the period covered. Importantly, DO NOT include vacation pay or earned wages.

- Indicate if the employee earned at least $3,500.00 during their employment by checking the relevant box. If the answer is 'NO', specify how much they earned along with the average weekly wage.

- Fill in the employer’s name and the full mailing address where communications regarding potential claims will be directed.

- Provide the company's Georgia DOL account number as it appears on the Employer's Quarterly Tax and Wage Report.

- The form must be signed by an authorized official or agent of the employer. Include their title and the date the form is being released to the employee.

- Choose to save changes, download, print, or share the form as necessary for your records.

Complete and submit the necessary documents online to ensure timely processing.

Employers can only deduct vacation pay with a valid authorization from the employee. The only way an employer is able to legally deduct money from an employee's wages, according to section 13 of the Employment Standards Act, is if the employee has signed a written statement authorizing the deduction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.