Loading

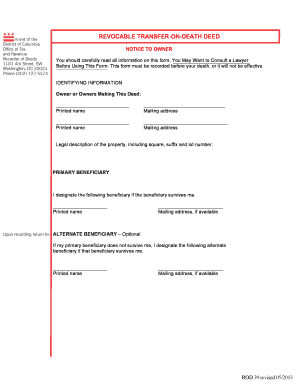

Get D.c. Revocable Transfer-on-death Deed - Otr Cfo Dc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the D.C. REVOCABLE TRANSFER-ON-DEATH Deed - Otr Cfo Dc online

Completing the D.C. revocable transfer-on-death deed is an important step in managing your property after your passing. This guide offers step-by-step instructions for accurately filling out the form online to ensure your wishes are fulfilled.

Follow the steps to complete the D.C. deed online.

- Click the ‘Get Form’ button to access the D.C. revocable transfer-on-death deed. Ensure the form is available in your chosen online editor.

- Begin by filling in the identifying information section. Enter your name as the owner or owners making this deed, along with your mailing address. If there are multiple owners, list each owner with their respective details.

- In the legal description section, provide accurate details of the property, including square, suffix, and lot number. This information is crucial for identifying the property in legal terms.

- Designate your primary beneficiary by entering their printed name and mailing address, if available. This person will receive the property if they survive you.

- If desired, designate an alternate beneficiary. Fill in their printed name and mailing address in the optional section provided. This beneficiary will inherit the property if the primary beneficiary does not survive you.

- Sign the deed in the designated signature section. Ensure that you date the document appropriately. If there are multiple owners, all owners must sign.

- Acknowledge the deed in front of a notary public. To have the deed recognized, it must be signed in the presence of a notary who will certify the execution.

- Once the deed is completed and notarized, submit the form to the Office of the Recorder of Deeds for recording. Make sure to follow any specific instructions provided by the office.

- After recording, you can choose to save a copy of the document, download it, print it, or share it as needed for your records.

Begin your process online today to secure your property wishes for the future.

The Basics: Transfer on Death Deed The Transfer on Death Property Act, codified at Indiana Code 32-17-14 et. seq., creates a means to plan for the transfer of real property upon death that allows the grantor to transfer their interest in real property without probate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.