Loading

Get Dr0026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr0026 online

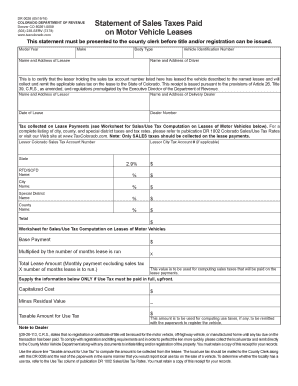

Filling out the Dr0026 form accurately is essential for the proper processing of sales taxes related to motor vehicle leases. This guide will walk you through each section of the form to ensure you provide the necessary information correctly.

Follow the steps to complete the Dr0026 form with ease.

- Click the ‘Get Form’ button to obtain the Dr0026 document and open it in your preferred online editor.

- Enter the date of lease in the specified format, ensuring clarity on when the lease agreement begins.

- Provide the vehicle year, make, and body type accurately to identify the specific vehicle being leased.

- Fill in the Vehicle Identification Number (VIN) in the designated field, verifying it matches the vehicle.

- Enter the name and address of the lessee, ensuring that all information is complete and up-to-date.

- Input the name and address of the driver, if different from the lessee, for record-keeping purposes.

- Provide the Colorado Sales Tax Account Number and City Tax Account Number, if applicable, to track tax obligations.

- Indicate the tax collected on lease payments, including the state, RTD/CD/FD tax, ensuring all figures are accurate.

- Complete the section for the name and address of the lessor and the delivering dealer, ensuring accurate representation of all parties involved in the transaction.

- Calculate and enter the total lease amount, excluding sales taxes, and the number of months the lease is to run.

- Complete the worksheet for sales/use tax computation on leases, ensuring all fields related to taxable amounts and computations are filled.

- Verify all entered details for accuracy before submitting the form.

- Once completed, save your changes, and choose to download, print, or share the Dr0026 form as necessary for submission.

Complete your Dr0026 form online today to ensure timely processing of your lease transaction.

The sales tax license allows a business to sell and collect sales tax from taxable products and services in the state, while the exemption certificate allows the retailer to make tax-exempt purchases for products they intend to resell. ... After registering, a sales tax number will be provided by the Department of Revenue.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.