Loading

Get Qdro

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Qdro online

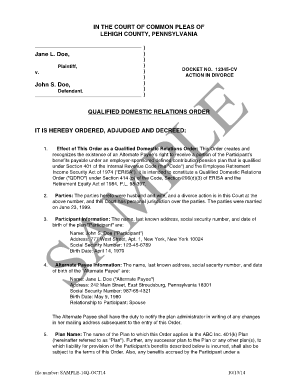

Filling out a Qualified Domestic Relations Order (QDRO) online can be a straightforward process if you follow the right steps. This guide will provide you with clear instructions to ensure that you complete the QDRO accurately and efficiently.

Follow the steps to complete the Qdro with ease.

- Use the ‘Get Form’ button to obtain the QDRO template and open it for editing.

- Begin by entering the names of the parties involved in the divorce. Include details such as the plaintiff and defendant’s names and any docket numbers specified in the court documents.

- Fill out the section regarding the effect of the order. Clearly state that this is a qualified domestic relations order and cite the relevant legal references to ensure compliance.

- Provide the necessary participant information. This includes the name, last known address, social security number, and date of birth of the party whose pension benefits are being divided.

- Next, input the alternate payee information. Ensure you include the same details as the participant and specify their relationship to the participant.

- Complete the plan name section by indicating the name of the employer-sponsored pension plan to which this order applies.

- Detail the amount of assignment, specifying the dollar amount that is assigned to the alternate payee, alongside any relevant conditions regarding account balances and investment earnings.

- Outline the provisions for payment to the alternate payee. Indicate how and when benefits will be distributed, including options for lump-sum payments or other permissible distribution methods.

- Complete the sections on the alternate payee's rights and the implications of potential changes, such as death of either party. Ensure all rights are clearly defined.

- Review the document for accuracy. Once all sections are complete and precise, you can save your changes, download the form, print it, or share it as needed.

Begin completing your Qdro online to ensure efficient processing.

A QDRO distribution that is paid to a child or other dependent is taxed to the plan participant. An individual may be able to roll over tax-free all or part of a distribution from a qualified retirement plan that he or she received under a QDRO.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.