Loading

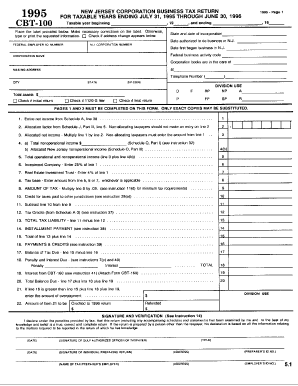

Get Cbt-100 - 1995 - Forms And Instructions - State Of New Jersey - State Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CBT-100 - 1995 - Forms And Instructions - State Of New Jersey - State Nj online

Filling out the CBT-100 form online is a straightforward process designed to assist users in managing their tax responsibilities. This guide provides step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to accurately complete the CBT-100 online.

- Click the ‘Get Form’ button to access the CBT-100 form and open it in your preferred document editing tool.

- Begin by entering your personal information in the designated fields, including your name, business name, and address. Ensure all details are accurate to avoid any processing delays.

- In the following section, provide information regarding your business structure, such as whether you are a corporation or partnership. Select the appropriate option from the provided list.

- Fill in the financial information section, which may include revenue, expenses, and other financial metrics relevant to your business operations.

- Review any accompanying schedules or additional forms that may be required for your specific business structure. Attach them as instructed.

- Once all sections are completed, thoroughly review your entries for accuracy. Ensure that all mandatory fields are filled and calculations, if any, are correct.

- Save your work frequently to avoid losing any information, and when satisfied with the completed form, use the options to download, print, or share the form as needed.

Take charge of your tax responsibilities by completing the CBT-100 online today.

The extension applies only to the filing of the return and does not extend the time to make all required payments. ... In order to maintain consistency with the federal tax extensions, estimated payments with an original due date of April 15, 2020, are extended to July 15, 2020.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.