Loading

Get Online Tax Verification

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Online Tax Verification form online

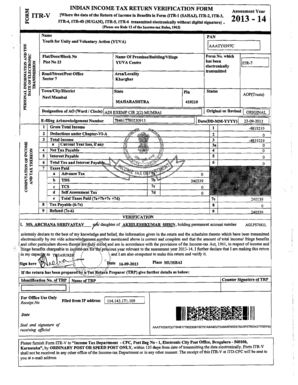

Filling out the Online Tax Verification form is a crucial step for individuals who have electronically submitted their income tax returns. This guide provides clear and supportive instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully fill out your Online Tax Verification form.

- Click ‘Get Form’ button to access the Online Tax Verification form.

- Begin by entering the assessment year for which you are verifying your tax return. This information is essential to ensure the verification aligns with the correct tax period.

- Fill in the details of your premises or residence, including your address, flat or plot number, and locality. Accurate information is crucial for identification purposes.

- Provide your full name as it appears on your Permanent Account Number (PAN) document. This ensures that your verification matches your tax records.

- Indicate the form number that was transmitted electronically. This can include forms such as ITR-1, ITR-2, ITR-3, etc.

- Select your status, such as 'AOP (Trusts)', from the provided options to clarify your filing status.

- Enter your PAN and the date of the transmission of your return for precise and transparent record-keeping.

- Review your declaration to ensure that all details are correct and complete. Acknowledge that you are competent to verify this return before signing it.

- Add any necessary information for the Tax Return Preparer (TRP) if applicable, along with their signature and identification number.

- Once you have filled in all fields and reviewed the information for accuracy, you can save your changes, download the form, print it, or share it as needed.

Complete your Online Tax Verification form now to ensure a smooth filing process.

Your personal account number from a: ... A mobile phone associated with your name. Your 5071C letter, 5747C letter, 5447C letter, or 6331C letter. The income tax return (form 1040,1040-PR, 1040-NR, 1040-SR, etc.) ... You must also have your mailing address from your previous year's tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.