Loading

Get Form W-4p From Irs - Central States Pension Fund

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-4P From IRS - Central States Pension Fund online

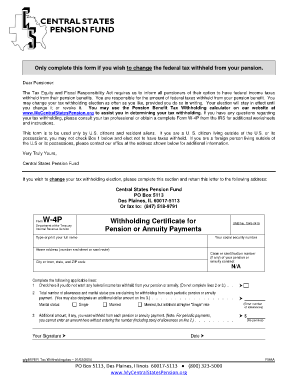

Filling out the Form W-4P is essential for pensioners wishing to adjust their federal income tax withholding from pension benefits. This guide provides step-by-step instructions to ensure that you accurately complete the form online.

Follow the steps to complete the Form W-4P accurately.

- Click ‘Get Form’ button to obtain the form and open it in your chosen document editor.

- Begin filling out the form by typing or printing your full name, social security number, and home address in the designated spaces provided at the top of the form.

- If you wish to elect not to have federal taxes withheld, check the box in line 1 and do not complete lines 2 or 3.

- If you want federal taxes withheld, select one of the marital status options in line 2 and indicate the total number of allowances you are claiming.

- In line 3, if desired, specify any additional dollar amount you want withheld from each pension or annuity payment, keeping in mind that you must also fill out line 2.

- Ensure you sign and date the form at the bottom before submitting it.

- Return the completed form to the Central States Pension Fund either by mailing it to the provided address or by faxing it.

Complete your Form W-4P online now to efficiently manage your tax withholding.

Form W-4R is to be used for your PLSO if you wish to withhold more than the standard 20% tax withholding on any portion paid directly to you. If you do not wish to withhold more than 20% on your PLSO, do not submit a W-4R. Form W-4P is to be used for your monthly annuity payments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.