Loading

Get Georgia Form 4562

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Georgia Form 4562 online

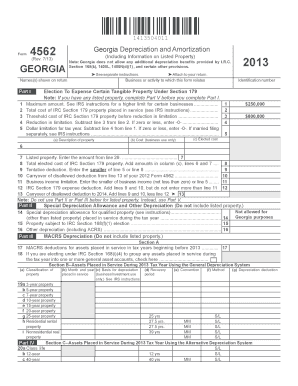

Filling out the Georgia Form 4562 online allows users to accurately report depreciation and amortization for tax purposes. This guide provides step-by-step instructions to help users navigate the form efficiently and effectively.

Follow the steps to complete the Georgia Form 4562 online.

- Press the ‘Get Form’ button to access the Georgia Form 4562 and open it in your preferred editor.

- Begin by entering your name or the name of the business as shown on the return at the top of the form.

- In Part I, specify the business or activity to which this form relates and provide the identification number associated with your tax return.

- Under Section 179, input the maximum amount for the current tax year, total cost of IRC Section 179 property placed in service, and the threshold cost before reduction. Calculate the reduction in limitation based on these inputs.

- Complete the elected cost of the property and determine the dollar limitation for the tax year, ensuring that if married filing separately, you check the IRS instructions.

- If applicable, provide details for listed property in Part V, ensuring that the form is filled out correctly for property used more than 50% for business.

- Continue through Parts II, III, and IV, filling out the special depreciation allowance and MACRS depreciation as necessary for your assets.

- After completing all relevant sections, review your entries for accuracy and completeness.

- Finally, you can save your changes, download the completed form, print it for your records, or share it as needed.

Start completing your Georgia Form 4562 online today for a streamlined filing experience.

If you're still unsure what you can deduct, this doesn't include short-lived assets such as small office supply purchases or inventory, but rather assets that will have a multi-year life such as vehicles, property, and machines. Every year that you deduct depreciation of that asset, you're required to file Form 4562.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.