Loading

Get Form 8960 - Internal Revenue Service - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8960 - Internal Revenue Service - Irs online

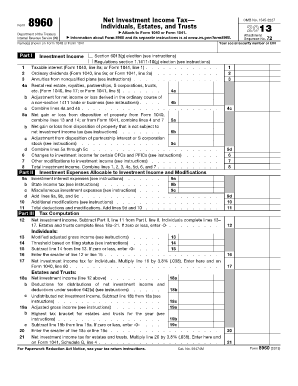

Filling out Form 8960 is essential for understanding and reporting net investment income tax. This guide provides a comprehensive overview of the form's sections and fields, equipping users with step-by-step instructions to complete the form online.

Follow the steps to accurately fill out Form 8960.

- Click ‘Get Form’ button to access the form and open it in your editor.

- Enter the name(s) shown on your Form 1040 or Form 1041 at the top of the form.

- In Part I, indicate any elections under Section 6013(g) and Regulations Section 1.1411–10(g) by checking the corresponding boxes.

- Fill in the income sources in lines 1 through 8. These include taxable interest, ordinary dividends, and other relevant investment income. Ensure the amounts correspond to your tax filings.

- In Part II, record investment expenses on lines 9a through 10. This includes investment interest expenses, state income taxes, and miscellaneous investment expenses.

- Calculate total deductions and modifications by adding lines 9d and 10, and record the result.

- In Part III, compute net investment income by subtracting the total from Part II (line 11) from the total investment income in Part I (line 8).

- For individuals, complete lines 13 through 17, determining your modified adjusted gross income and the net investment income tax. Follow the instructions to ensure accuracy.

- If applicable, for estates and trusts, complete lines 18a through 21, making the necessary calculations for undistributed net investment income. Ensure you follow the provided instructions carefully.

- Once you have filled out all sections, save your changes. You can download, print, or share the completed Form 8960 as needed.

Start completing your Form 8960 online to ensure accurate reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The federal tax laws require brokerage firms, mutual funds, and other entities to report on Form 1099 all investment income, usually interest or dividends, they have paid to investors during the previous tax year. Form 1099 is a tax form required by the Internal Revenue Service.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.