Loading

Get Application - Lake County Property Appraiser

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application - Lake County Property Appraiser online

This guide provides a comprehensive overview of how to accurately fill out the Application for Limited Income Senior Exemption for the Lake County Property Appraiser online. By following these clear steps, you can ensure that your application is completed correctly and submitted in a timely manner.

Follow the steps to successfully complete your application online:

- Press the ‘Get Form’ button to access the application form and open it in your preferred editor.

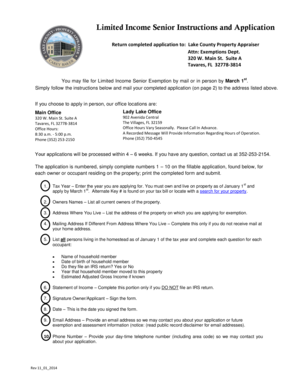

- Enter the tax year for which you are applying. Ensure that you are the owner and occupant of the property as of January 1 of the tax year, and remember that applications must be submitted by March 1.

- List all current owners of the property in the designated field for owners' names.

- Provide the address where you live, ensuring it matches the property for which you are applying.

- If your mailing address is different from your home address, fill in that information in the respective field.

- List all individuals residing in the homestead as of January 1. Complete the fields for each household member, including their name, date of birth, whether they file an IRS return, the year they moved to the property, and their estimated adjusted gross income if known.

- Complete the statement of income section only if you do not file an IRS return, providing the necessary income information for each applicable household member.

- Sign the form in the designated owner/applicant signature area to validate your application.

- Input the date on which you signed the form.

- Provide your email address for future communications regarding your application or any exemption information.

- Enter your day-time telephone number, including the area code, so that the property appraiser may contact you if needed.

- Once all fields are completed, save your changes, and choose to download, print, or share the form as needed.

Complete your Application for Limited Income Senior Exemption online today to ensure timely processing.

You can apply for your homestead exemption via mail or in person. You may be able to apply online too; check out your local county's website to see your options. Once you purchase your home, apply for your exemption by your state deadline for the tax year in which you want to qualify.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.