Loading

Get 2ez Table 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2ez Table 2019 online

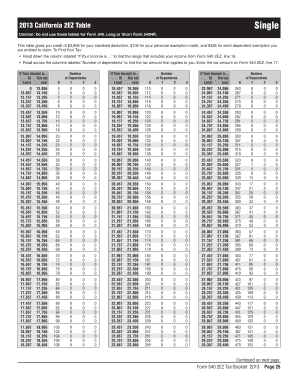

Filling out the 2ez Table 2019 is a crucial step in reporting your tax calculations accurately. This guide provides a clear and comprehensive overview of how to complete the form online, ensuring you follow each step with confidence.

Follow the steps to complete the 2ez Table 2019 online effectively.

- Use the ‘Get Form’ button to access the 2ez Table 2019 and open it in your browser.

- Identify the 'If Your Income is...' column and locate your reported income amount from Form 540 2EZ.

- Find the row that encapsulates your income range. Ensure you select the correct portion of the table that corresponds to your specific income.

- Navigate through the columns under 'Number of dependents' to determine the credit you qualify for based on the number of dependents you have.

- Once you have identified the appropriate cell in the table, make a note of the tax amount you need to enter.

- Proceed to Form 540 2EZ and input the identified tax amount in line 17.

- Review all entries for accuracy and save your changes. You may also choose to download or print the completed form for your records.

Get started on completing your documents online today!

For instance, low-income families may qualify for the Earned Income Tax Credit (EITC) federally, and the California EITC on their state tax return. This can pay anywhere from $275 to $6,935. So as long as you earned income, there is no minimum to file taxes in California.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.