Loading

Get Employee Earnings Record Example

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employee Earnings Record Example online

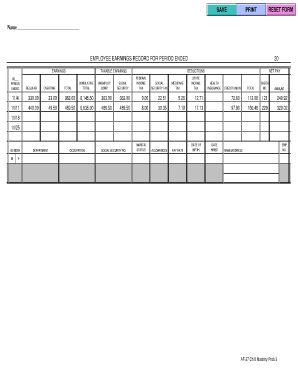

The Employee Earnings Record Example is an essential document for tracking employee earnings and deductions. This guide will provide you with clear, step-by-step instructions to effectively complete the form online, ensuring accurate and complete submission.

Follow the steps to fill out the Employee Earnings Record Example online.

- Press the ‘Get Form’ button to access the Employee Earnings Record and open it in your selected editor.

- Begin by entering your name in the designated field at the top of the form. Make sure your name is spelled correctly.

- In the ‘Earnings’ section, input the appropriate period for which you are reporting earnings. Specify the end date in the provided field.

- Document your regular earnings by entering the amount in the ‘Regular’ field. This represents standard hours worked.

- If applicable, fill in the ‘Overtime’ field with the total earnings accrued from overtime hours worked.

- Add up your taxable earnings and enter the total in the ‘Taxable Earnings’ field.

- Calculate the cumulative total and record this figure in the ‘Cumulative Total’ section.

- Continue to the ‘Deductions’ section, filling in the fields for Federal Income Tax, Social Security Tax, Medicare Tax, and State Income Tax based on your earnings.

- In the ‘Net Pay’ section, document any health insurance or credit union deductions you have.

- Record your total deductions at the bottom of the deductions section.

- Ensure you enter your check number and the corresponding amount next to it.

- Review the entire form for accuracy, making sure all information is correctly entered.

- Once complete, save your changes, and download or print the form as needed.

Complete your Employee Earnings Record Example online today!

Your Earnings Statement provides employees detailed information on the additions to and subtractions from gross salary or wage in order to arrive at your net pay. Net pay is your “take home” pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.