Loading

Get Form 2ec - Montana Department Of Revenue - Revenue Mt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2EC - Montana Department Of Revenue - Revenue Mt online

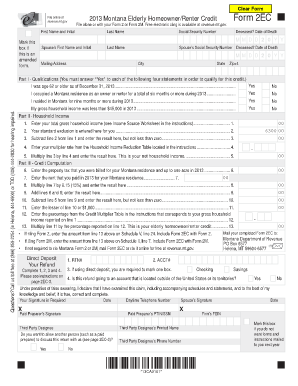

Filling out the Form 2EC from the Montana Department of Revenue can seem daunting, but with clear guidance, you can complete it efficiently online. This guide will walk you through each step of the form, ensuring you have all the necessary information to file correctly.

Follow the steps to successfully complete Form 2EC online.

- Click the 'Get Form' button to access the form in your online editor.

- Begin by entering your first name and initial in the designated fields. If applicable, mark the box to indicate if this is an amended form.

- Fill in your mailing address, ensuring to include the city, state, and ZIP+4 code accurately.

- In Part I, respond to all four qualification statements. You must answer 'Yes' to each to qualify for the credit. If you answer 'No' to any statement, you are not eligible.

- Proceed to Part II. Start by entering your total gross household income on line 1. Make sure to include all applicable income sources.

- Look up your multiplier rate from the Household Income Reduction Table in the instructions and enter it on line 4.

- In Part III, input the property tax you were billed for your residence on line 6, followed by the rent you paid in 2013 on line 7.

- Subtract line 5 from line 9 and enter the result on line 10, but ensure it is not less than zero.

- Find the applicable percentage from the Credit Multiplier Table based on your gross household income and enter this figure on line 12.

- If filing with Form 2 or Form 2M, follow the instructions for entering the credit on those forms. If filing alone, proceed to direct deposit information if applicable.

- Enter your bank details for a direct deposit refund on the specified lines, marking whether it's a checking or savings account.

- Make sure to sign and date the form in the designated area. If filing jointly, include your spouse's signature.

- Finally, review your form for accuracy, then save your changes, download a copy, print it for your records, or share it as required.

Ready to file your Form 2EC online? Start the process now!

Montana Individual Income Tax Return (Form 2) - Montana Department of Revenue. Information is now available for the 2023 Montana Individual Income Tax and Property Tax Rebates. Learn More.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.