Loading

Get 1 4 08 Non Emergency Amb Form.doc. Transaction Privilege Tax Rates

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1 4 08 Non Emergency Amb Form.doc. Transaction Privilege Tax Rates online

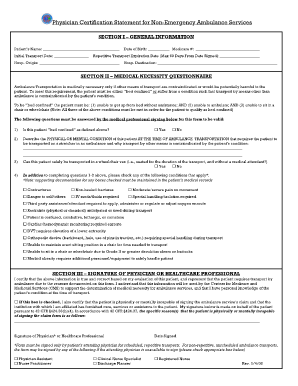

Filling out the 1 4 08 Non Emergency Amb Form is essential for documenting the medical necessity of ambulance services. This guide will provide clear instructions on how to complete the form accurately and effectively.

Follow the steps to complete the form thoroughly.

- Click the ‘Get Form’ button to obtain the form and open it in your chosen editing tool.

- In Section I, enter the patient's name, date of birth, and Medicare number. Ensure the details are accurate as this information is essential for identification and processing.

- Provide the initial transport date, and if applicable, enter the repetitive transport expiration date, which should not exceed 60 days from the signed date.

- List the hospital origin and destination to indicate the route for the transport.

- Proceed to Section II and answer the medical necessity questionnaire. Indicate if the patient is 'bed confined' by checking the relevant box.

- Describe the patient's physical or mental condition at the time of transport, focusing on why ambulance transport is required.

- Check the box indicating if the patient can be safely transported in a wheelchair van, along with any other applicable medical conditions that necessitate ambulance transport.

- In Section III, ensure a physician or healthcare professional signs the form, confirming the information provided is accurate and represents the patient's necessity for ambulance services.

- Once completed, review all fields for accuracy. You can then save the changes, download, print, or share the filled form as required.

Complete the 1 4 08 Non Emergency Amb Form online to ensure timely processing for transportation needs.

Although commonly referred to as a sales tax, the Arizona transaction privilege tax (TPT) is actually a tax on a vendor for the privilege of doing business in the state. Various business activities are subject to transaction privilege tax and must be licensed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.