Loading

Get Sba Quick Reference Guide 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sba Quick Reference Guide 2020 online

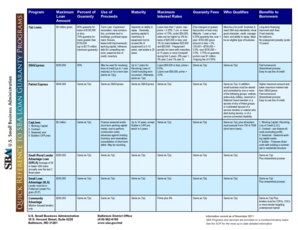

The Sba Quick Reference Guide 2020 is an essential tool for understanding the various loan options available through the Small Business Administration. This guide provides detailed information about each loan program, including eligibility requirements, use of proceeds, and benefits to borrowers.

Follow the steps to effectively complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the interactive editor.

- Review the introduction section of the form to understand the purpose and importance of the guide.

- Navigate through the various loan programs listed in the guide and select the appropriate program based on your business needs.

- Fill in the required fields for the chosen loan program, ensuring all necessary information is accurate and complete. Pay attention to details such as maximum loan amounts and percentage guarantees.

- Indicate the intended use of proceeds, selecting from options like expansion, renovation, or inventory purchase, and ensure you provide any relevant supporting details.

- Review the eligibility criteria for the loan you are applying for to confirm that you meet all requirements. This may include characteristics like business type and financial stability.

- Detail the financial aspects of your request, including proposed maturity period, expected interest rates, and any applicable guaranty fees associated with the loan.

- Once all sections are completed, review the entire form for accuracy. Make any necessary adjustments to ensure clarity and correctness.

- When satisfied with your completed form, you can save changes, download, print, or share the document as needed.

Start your journey to secure funding by completing your SBA documents online today!

SBA Express This term loan or line of credit offers fixed or variable SBA loan rates as well as the easiest SBA application process, quick approval times, flexible terms, and lower down payment requirements than conventional loans.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.