Loading

Get Instructions Virginia Form 500

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions Virginia Form 500 online

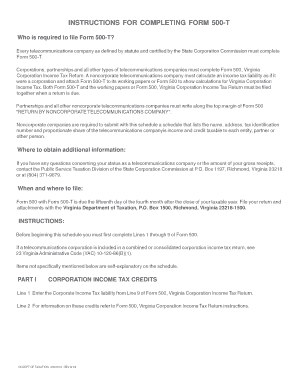

Filling out the Instructions Virginia Form 500 is essential for telecommunications companies to comply with state tax requirements. This guide will provide you with clear, step-by-step instructions to complete the form effectively online.

Follow the steps to complete the Instructions Virginia Form 500.

- Press the ‘Get Form’ button to obtain the form and access it in your online processor.

- Before starting on Form 500-T, complete Lines 1 through 9 of Form 500, the Virginia Corporation Income Tax Return.

- For Part I, Corporation Income Tax Credits, enter your Corporate Income Tax liability from Line 9 of Form 500 in Line 1. For Line 2, refer to the instructions of Form 500 for applicable credits.

- In Part II, Minimum Tax Computation, determine whether Line 7 corresponds with the Adjusted Corporate Income Tax liability on Line 3 of Part I. If so, continue filling Form 500 starting from Line 10 using the relevant credits.

- If Line 7 matches the Minimum tax amount, enter this amount on Line 11 of Form 500 and proceed to complete the form starting from Line 12.

- Refer to the Minimum Tax Rate Schedule to find the correct tax rate corresponding to your gross receipts during the applicable calendar year.

- For noncorporate telecommunications companies (Part III), calculate your minimum tax liability and income tax liability as if you were a corporation. Attach a statement showing how the corporate income tax was calculated.

- Once all fields are completed and reviewed, save your changes. You can then download, print, or share the form as needed.

Start completing relevant documents online today to ensure your compliance and accuracy.

Capital Gains Tax Basics Gains on the sale of personal or investment property held for more than one year are taxed at favorable capital gains rates of 0%, 15% or 20%, plus a 3.8% investment tax for people with higher incomes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.