Loading

Get Form 500x Virginia

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 500x Virginia online

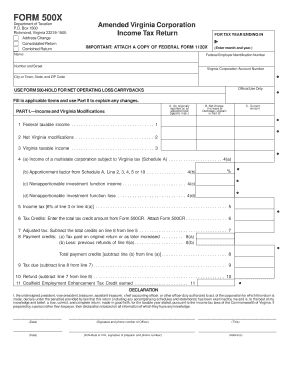

Filling out the Form 500x Virginia is an essential step for amending your Virginia Corporation Income Tax return. This guide provides a clear and detailed walkthrough for users at all levels of experience, ensuring that you can successfully complete the form online.

Follow the steps to fill out the Form 500x Virginia accurately.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In the 'Tax year ending in' section, enter the month and year relevant to the original return you are amending.

- In Part I, start with line 1 by entering the amount from the original return or last adjusted. Proceed to line 2 to input total Virginia modifications.

- Complete line 6 by entering the total tax credits from Form 500CR. Ensure to attach this form.

- Calculate the tax due or refund by following the instructions on lines 9 and 10 respectively. Document the results clearly.

- Complete Part II with an explanation of changes, referencing the appropriate line numbers and justifications.

- Finally, save the changes, and download, print, or share the form as needed after reviewing for accuracy.

Complete your Form 500x Virginia online today for timely amendments!

VA-16. any. Employer Quarterly Reconciliation of VA-15 Payments and Return of Virginia Income Tax Withheld - Semiweekly Filers. File Online.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.