Loading

Get Ri Form 4264a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ri Form 4264a online

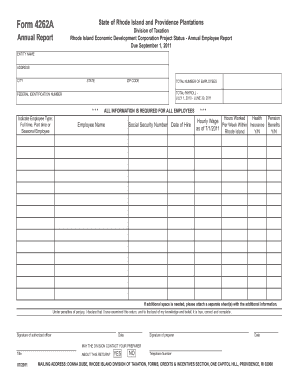

This guide provides a step-by-step approach to completing the Ri Form 4264a online, ensuring that users can accurately report their project status and employee information. By following these instructions, you will be able to navigate the form with confidence and ease.

Follow the steps to complete the Ri Form 4264a online

- Press the ‘Get Form’ button to access the Ri Form 4264a and open it in your digital interface.

- Begin by entering the entity name in the designated field. This is the official name of your business or organization.

- Fill in the address, city, state, and zip code where your entity is located. Ensure all details are accurate.

- Indicate the total number of employees in the provided field.

- Report the total payroll amount for the period of July 1, 2010, to June 30, 2011.

- Enter the Federal Identification Number (FIN) assigned to your entity.

- Choose the type of employees your entity has. You can select from full-time, part-time, or seasonal employees.

- Complete the section that details hours worked for each employee. This includes their names and social security numbers.

- For every employee listed, include the date of hire, whether they receive health insurance and pension benefits, and their hourly wage.

- If additional space is needed for more employees, attach separate sheets with the required information.

- Once all fields are completed, ensure that the authorized officer signs the form and dates it.

- Have the preparer of the form sign and date it as well, if applicable.

- Indicate whether the division may contact your preparer regarding any questions about this return.

- Finally, review the completed form for accuracy, then save your changes, and choose to download, print, or share the form as needed.

Get started with filling out your documents online today!

Estate Tax Exemption Amounts Rhode Island: If a person's taxable estate totals less than $1,733,264* there is no estate tax to be paid. If the taxable estate exceeds $1,733,264, the estate tax is assessed on all assets of the decedent above the $1,733,264 exemption amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.