Loading

Get 941c1 Me Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 941c1 Me Form online

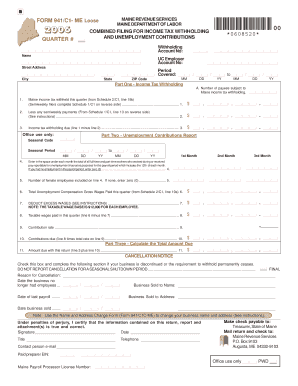

The 941c1 Me Form is essential for reporting income tax withholding and unemployment contributions in Maine. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring accuracy and compliance.

Follow the steps to successfully complete your 941c1 Me Form.

- Click ‘Get Form’ button to obtain the form and open it in an online editor.

- Enter your withholding account number and UC employer account number in the designated fields.

- Fill in your name, business address, and period covered fields accurately.

- In Part One, report the number of payees subject to Maine income tax withholding. Provide the amount withheld this quarter and subtract any semiweekly payments to determine the income tax withholding due.

- Proceed to Part Two to report Unemployment Contributions. Input the total number of full-time and part-time workers for each month. Complete the section to indicate the number of female employees and total unemployment compensation gross wages paid.

- Calculate the taxable wages and enter the contribution rate. Finally, determine the contributions due for the quarter.

- In Part Three, sum the amounts due from Part One and Part Two to find the total amount due with the return.

- If applicable, check the cancellation notice box and provide the required cancellation details.

- Sign and date the form, listing your title and contact information clearly.

- Once all fields are completed, save your changes. You can download, print, or share the form as needed.

Complete your documents online with confidence and accuracy.

Companies who pay employees in Maine must register with the ME Revenue Service for a Withholding Account Number and the ME Department of Labor for an Employer Account Number. Apply online for both account numbers. Apply online to receive a Withholding Account Number in 2-3 days.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.