Loading

Get Fillable Form Sev O 1d

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable Form Sev O 1d online

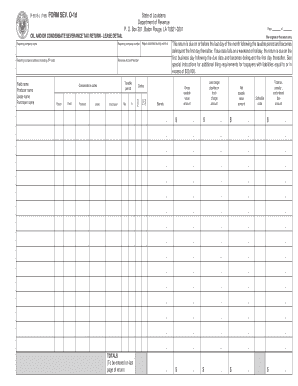

The Fillable Form Sev O 1d is essential for individuals and companies reporting oil and condensate severance taxes in Louisiana. This guide will provide step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully fill out the Fillable Form Sev O 1d.

- Click the ‘Get Form’ button to obtain the Fillable Form Sev O 1d and open it in your preferred online editor.

- Fill in the reporting company name and address. This section is self-explanatory and requires the name and complete address of the reporting entity.

- Enter the reporting company number, which is the producer or transporter code number assigned by the Louisiana Office of Conservation.

- Indicate the month during which the return is submitted by filling in the 'Report submitted during month of' field.

- Provide your Revenue Account Number, which is a 10-digit Louisiana Tax Number related to various tax obligations.

- Fill in the fields for Field, Producer, Lease, and Purchaser names. Ensure that the names are accurate and correspond to the producer and lease details.

- Complete the sections for Parish, Field, Producer, and Lease codes, as these are assigned by the Louisiana Office of Conservation.

- Specify the taxable period for which the tax is due. Separate reports should be made for different taxable periods.

- Choose the appropriate Kind code to identify the category of resource being reported based on the provided legend.

- Select the Tax rate code that designates the tax rate applicable to your resource, referring to the tax rate legend for guidance.

- Enter the total barrels for the taxable period applicable to the current form. Ensure accurate calculations.

- Fill in the gross taxable value amount, which reflects the gross value of the resource being reported.

- Input the barge, pipeline, or truck charge amount if any charges have been deducted by the first purchaser.

- Calculate the net taxable value amount by deducting any transportation charges from the gross taxable value.

- Select the Schedule code corresponding to the type of return and provide it in the designated field.

- Calculate and enter the total tax, penalty, and interest amount based on the net taxable value and applicable rates.

- At the end, ensure you have filled in the totals fields, which should correspond to the last page of the return.

- Finally, save your changes, download, print, or share the completed form as per your requirements.

Start filling out your Fillable Form Sev O 1d online today for accurate reporting and compliance.

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.