Loading

Get Where Do You Mail For R 1086 To Louisiana Department Of Revenue Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Where Do You Mail For R 1086 To Louisiana Department Of Revenue Form online

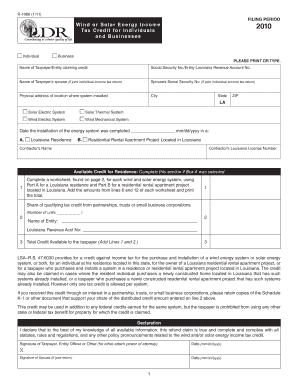

Filling out the Where Do You Mail For R 1086 To Louisiana Department Of Revenue Form is essential for individuals and businesses claiming a credit for wind or solar energy systems. This guide provides a detailed, step-by-step approach to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the R 1086 form online.

- Press the 'Get Form' button to obtain the R 1086 form and open it in your preferred online document editor.

- Enter the name of the taxpayer or entity claiming the credit. Make sure to print or type clearly to avoid any confusion.

- Fill in the Social Security number or Louisiana Revenue Account number of the taxpayer. This information is crucial for processing your claim.

- If filing jointly, complete the name and Social Security number fields for the taxpayer’s spouse.

- Provide the physical address where the energy system is installed, including city, state, and ZIP code.

- Check the appropriate boxes indicating the type of energy system installed, such as solar electric, wind electric, solar thermal, or wind mechanical.

- Indicate the date the installation was completed using the mm/dd/yyyy format.

- Select whether the system is installed in a Louisiana residence or a residential rental apartment project located in Louisiana.

- Fill in the contractor’s name and Louisiana license number, ensuring the contractor is licensed to operate in the state.

- Complete the credit calculation sections based on whether you are a homeowner or involved with a residential rental apartment project, filling out either Part A or Part B accordingly.

- Add the necessary amounts from the worksheets as prompted in the form instructions.

- Sign and date the declaration section, along with your spouse if filed jointly, affirming the accuracy of the information provided.

- Once all sections are completed, save the changes, and consider downloading, printing, or sharing the completed form as necessary.

Start filling out the Where Do You Mail For R 1086 To Louisiana Department Of Revenue Form online today to ensure you secure your energy tax credits.

The Louisiana Department of Revenue is responsible for administering and enforcing tax laws and related statutes established by the state. ... The office also monitors licenses for compliance with gaming laws and regulations and trains gaming organizations in the proper use of the Uniform Accounting System.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.