Loading

Get 1065x 2010 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1065x 2010 form online

Filling out the 1065x 2010 form online can be a straightforward process with the right guidance. This guide provides detailed, step-by-step instructions to help users accurately complete each section of the form, ensuring compliance and ease of submission.

Follow the steps to complete the 1065x 2010 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

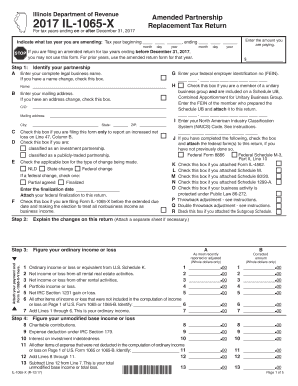

- Indicate the tax year you are amending by filling in the beginning and ending dates.

- Identify your partnership by entering your complete legal business name and mailing address. If your address has changed, mark the appropriate box.

- Enter your federal employer identification number (FEIN), and if applicable, check any relevant boxes regarding changes or classifications.

- Explain the changes on this return in the provided section, attaching a separate sheet if necessary.

- Complete calculations for ordinary income or loss as instructed in the relevant sections, ensuring to provide whole dollar amounts.

- Follow the steps to figure out your unmodified base income or loss by reporting various income types and deductions.

- Continue filling out the form by calculating the income allocable to Illinois, ensuring to follow any specific instructions for each line.

- Figure your net income and prepare for any replacement tax, ensuring to carry out the necessary calculations for line items.

- Determine your refund or balance due, ensuring to check payments and credits from prior years.

- Sign the form where indicated, affirming that the information provided is accurate and complete, then prepare your submission.

- Once all sections are completed, you can save changes, download, print, or share the form as required.

Start filling out your 1065x 2010 form online today to ensure a smooth amendment process.

Related links form

Where To File. Form 1065X must be filed with the service center where the original return was filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.