Loading

Get Ri Form Ri W-3 2024-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI Form RI W-3 online

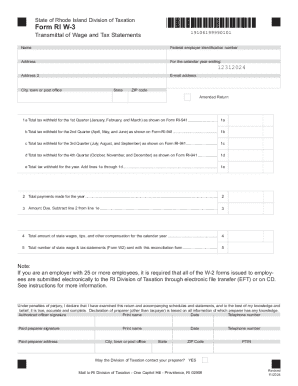

Filling out the RI Form RI W-3 online can streamline the process of submitting wage and tax information to the Rhode Island Division of Taxation. This guide will walk you through each section of the form, ensuring that you provide accurate and complete information.

Follow the steps to fill out the form effectively.

- Click 'Get Form' button to access the RI W-3 form and open it in your preferred editor.

- Begin by entering your name, federal employer identification number, and address in the designated fields. Ensure that all information is accurate as it will be used for tax purposes.

- Indicate the calendar year for the form, which in this case is '12312024'. Include your email address and city or town of operation.

- Complete the quarters section by entering the total tax withheld for each respective quarter as shown on Form RI-941. Input values for 1a (First Quarter), 1b (Second Quarter), 1c (Third Quarter), and 1d (Fourth Quarter). The total for the year will automatically be computed in line 1e, so ensure your entries are correct.

- Record the total payments made for the year in line 2. This figure represents what has been paid in total for state withholding.

- Calculate the amount due by subtracting line 2 from line 1e and enter the result in line 3. This indicates any outstanding balance to the state.

- Fill out the total amount of state wages, tips, and other compensation in line 4 to give a complete picture of what has been reported.

- Indicate the total number of state wage and tax statements (Form W-2) submitted along with this reconciliation form in line 5.

- Review the declaration statement carefully. Here, the authorized officer will need to sign, print their name, date, and include their telephone number. If a paid preparer was involved, they must also sign and provide their details.

- Determine whether the Division of Taxation may contact your preparer by selecting 'YES' or 'NO'.

- Finally, save your changes, and consider downloading, printing, or sharing the completed form for your records. Ensure that it is mailed to the specified address: RI Division of Taxation - One Capitol Hill - Providence, RI 02908.

Complete the RI Form RI W-3 online today for a seamless tax reporting process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.