Loading

Get Fiduciary Return Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fiduciary Return Form online

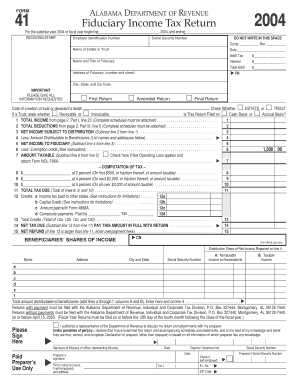

The Fiduciary Return Form is essential for reporting the income, deductions, and tax liability of estate or trust entities. This guide provides a step-by-step approach to completing the form online, ensuring that users have the necessary tools to accurately submit the required information.

Follow the steps to complete the Fiduciary Return Form online

- Click 'Get Form' button to access the Fiduciary Return Form and open it in the preferred editor.

- Begin by entering the employer identification number and the social security number. If applicable, provide the name and title of the fiduciary along with their address, including city, state, and zip code.

- Indicate whether this is the first return, an amended return, or a final return by checking the appropriate boxes.

- Specify the type of trust or estate. Indicate the date of creation of the trust or decedent’s death and check whether it is a revocable or irrevocable trust.

- Choose whether the return is filed on a cash basis or an accrual basis.

- Input total income and total deductions in the designated sections on the form. Ensure that all necessary schedules are attached.

- Calculate the net income subject to distribution by subtracting total deductions from total income.

- Enter the amount distributable to beneficiaries. List their names and addresses as required.

- Calculate the net income to fiduciary by subtracting the amount distributable to beneficiaries from the net income subject to distribution.

- Complete the computation of tax by filling in the appropriate tax brackets based on the amount taxable.

- After filling in all necessary fields, review for accuracy. Save changes, or choose to download, print, or share the completed form.

Complete your Fiduciary Return Form online today for accurate and timely submissions.

A fiduciary is a person or organization that acts on behalf of another person or persons, putting their clients' interest ahead of their own, with a duty to preserve good faith and trust. Being a fiduciary thus requires being bound both legally and ethically to act in the other's best interests.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.