Loading

Get State Of Iowa 54028 Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Of Iowa 54028 Application Form online

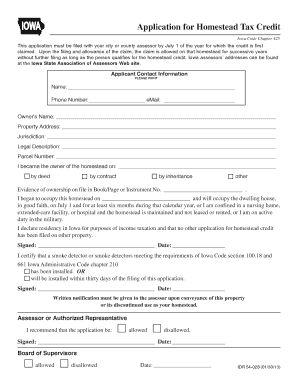

The State Of Iowa 54028 Application Form is essential for individuals seeking a homestead tax credit. Filling out this form correctly ensures that you can claim the credit for your homestead property, providing financial relief on property taxes.

Follow the steps to fill out the State Of Iowa 54028 Application Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your contact information in the designated fields. Include your name, phone number, and email address to ensure the assessor can reach you if needed.

- Next, provide the owner’s name, property address, jurisdiction, legal description, and parcel number of the property in question.

- Indicate the date you became the owner of the homestead by selecting the appropriate method of acquisition, such as deed, contract, inheritance, or other.

- Fill in the evidence of ownership as recorded in the relevant book/page or instrument number.

- State the date you began to occupy the homestead and confirm your intent to occupy the dwelling in good faith for the required duration.

- Declare your residency in Iowa for income taxation purposes and confirm that no other application for homestead credit has been submitted on different property.

- Sign and date the application to certify the information provided is accurate.

- Complete the section regarding smoke detector installation, confirming that the required detectors are installed or will be installed within thirty days.

- Finally, the assessor or authorized representative must review and sign the application, indicating whether they recommend it to be allowed or disallowed.

- Once all fields are completed, you can save your changes, download, print, or share the form as needed.

Complete your State Of Iowa 54028 Application Form online today to secure your homestead tax credit.

Related links form

In the state of Iowa, this portion is the first $4,850 of your property's net taxable value. How the Homestead Exemption Works: When it comes to the homestead exemption, it's up to you to take the initiative.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.