Loading

Get Delaware Form 5401

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Delaware Form 5401 online

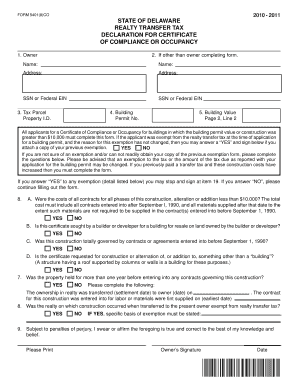

Filling out the Delaware Form 5401 is an essential step for obtaining a Certificate of Compliance or Occupancy when the building permit value exceeds $10,000. This guide provides clear and user-friendly instructions to facilitate the online completion of this form.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to access the form digitally and open it in the document editor.

- Begin by filling out the owner information in Section 1. Include the name of the property owner and, if applicable, the name and address of the person completing the form if they are not the owner.

- Enter the tax parcel property ID in Section 3. This number is crucial for identifying the property involved in the transaction.

- In Section 4, provide the building permit number related to the construction.

- Section 5 requires you to assess the building value. Ensure you accurately report the total cost of all contracts and materials associated with the construction.

- Review the exemption questions and answer yes or no as applicable. If you qualify for an exemption from the realty transfer tax, ensure you sign at item 19 and attach any necessary documentation.

- Follow through the subsequent questions, providing details about contracts and agreements. Make sure to include dates related to the transfer of realty and the contractual obligations.

- Complete the affirmation section by signing and dating the form. Ensure that the information provided is correct to the best of your knowledge.

- Once all the sections are filled out completely, save your changes and choose to download, print, or share the form as needed.

Complete the Delaware Form 5401 online today to ensure a smooth application process for your Certificate of Compliance or Occupancy.

If the property is located in an area that does not impose a local transfer tax, the state realty transfer tax rate is now 3%. Realty transfer taxes are typically shared equally by the buyer and the seller.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.