Loading

Get Application For Refund Or Direct Rollover - Nd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the APPLICATION FOR REFUND OR DIRECT ROLLOVER - Nd online

This guide provides a detailed overview of the steps required to complete the APPLICATION FOR REFUND OR DIRECT ROLLOVER - Nd online. It is designed to help you navigate the form efficiently, ensuring that you understand each section and its requirements.

Follow the steps to fill out the application accurately.

- Click the ‘Get Form’ button to access the APPLICATION FOR REFUND OR DIRECT ROLLOVER - Nd and open it for completion.

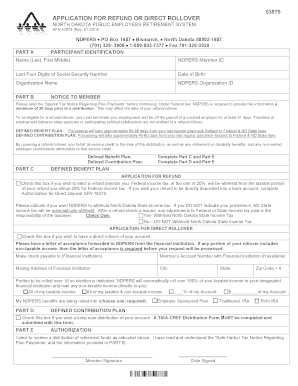

- In Part A, you need to fill out your participant identification. Provide your full name (last, first, middle), NDPERS member ID, last four digits of your social security number, date of birth, organization name, and NDPERS organization ID.

- Read Part B carefully, which contains important notices regarding your refund or rollover options and tax implications. Ensure you understand the terms outlined before proceeding.

- In Part C, select whether you are applying for a refund from the defined benefit plan or a direct rollover. If applying for a refund, check the appropriate box and specify tax withholding preferences. If opting for a direct rollover, provide all required information including financial institution details and the specifics of the account.

- For direct rollovers, ensure that you attach or request a letter of acceptance from the financial institution where the rollover will occur.

- Next, complete Part D if you are electing a refund from a defined contribution plan, and ensure to attach the necessary distribution form.

- Finally, in Part E, sign and date the application to authorize the distribution of retirement funds as indicated. This signature validates your application.

- Review the completed form for accuracy, then save your changes. You can download, print, or share the form as needed.

Take the next step in managing your retirement by completing your APPLICATION FOR REFUND OR DIRECT ROLLOVER - Nd online today!

The institution that manages your IRA will send you Form 5498 to report to the IRS any IRA contributions, rollovers, Roth IRA conversions, and required minimum distributions you made during the tax year. If you didn't make any contributions, you won't receive a form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.