Loading

Get Form 26q Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 26q Pdf online

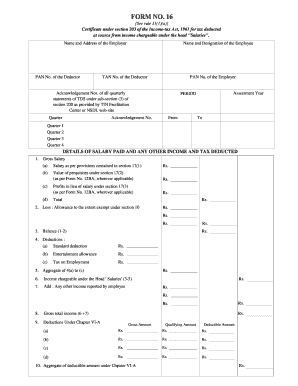

Filling out Form 26q is crucial for reporting tax deducted at source from income that falls under the category of salaries. This guide will assist you in navigating the form's components and completing it accurately online.

Follow the steps to fill out Form 26q online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name and address of the employer in the designated fields to ensure accurate identification.

- Fill in the PAN number of the deductor and the TAN number of the deductor. These identifiers are essential for tax reporting.

- Input the PAN number of the employer to further link the tax deduction details with the appropriate entity.

- Add the acknowledgement numbers of all quarterly statements of TDS, as provided by the TIN Facilitation Center. This ensures your form is in compliance with tax regulations.

- For each quarter (1 to 4), specify the assessment year and the period by entering the relevant acknowledgement number.

- In the section detailing salary paid and any other income, accurately fill in the gross salary, including the value of perquisites and profits in lieu of salary.

- Deduct any allowances exempt under section 10 from the gross salary to calculate the balance.

- Enter deductions such as standard deduction, entertainment allowance, and tax on employment in the respective fields.

- Calculate the aggregate of these deductions to derive the income chargeable under the head 'Salaries'.

- Add any other reported income by the employee to your total salary to compute the gross total income.

- Apply any deductions under Chapter VI-A, making sure to itemize each deductible amount.

- Calculate and fill out the total income, tax on total income, and any applicable rebates.

- Finally, verify your entries, ensuring all fields are completed accurately. Once satisfied, save your changes, download the form, print it, or share it as needed.

Complete your documents online today to ensure compliance and accuracy.

Steps to Download Form 26QB Justification Report from TRACES Log in to TRACES. Log in to TRACES – Enter User Id, Password, PAN and captcha. Navigate to justification report download. ... Form 26QB. ... Enter the required details. ... Enter CIN details. ... Success Message. ... Navigate to requested downloads. ... Enter the request number/date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.