Loading

Get St 9 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 9 Form online

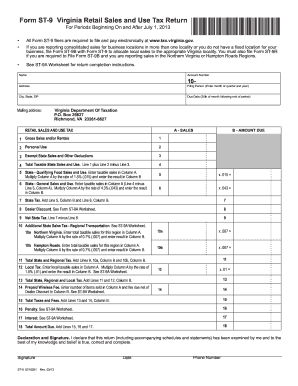

Filling out the St 9 Form online can streamline your reporting process for retail sales and use tax. This comprehensive guide provides clear instructions to help you complete the form accurately and efficiently.

Follow the steps to effectively complete the St 9 Form online.

- Click ‘Get Form’ button to obtain the St 9 Form and open it in the necessary editor.

- Begin by entering your name at the designated section. This should reflect the legal name of the business or individual filing the form.

- Next, input your account number. This will help identify your tax records in the Virginia Department of Taxation system.

- Fill in your address, including city, state, and ZIP code. This address will be used for correspondence regarding your tax submissions.

- Specify the filing period by entering the month or quarter and the year for which you are reporting sales.

- Enter the due date, which is the 20th of the month following the end of the reporting period. Ensuring you meet this deadline is crucial for compliance.

- In the 'Sales and Use Tax' section, accurately report your gross sales and/or rentals. It is critical to include all sales made during the reporting period.

- Report personal use items. Enter the cost price of tangible personal property without sales tax that you have withdrawn from inventory.

- Complete the deductions section by entering exempt state sales and other applicable deductions, as specified in the guiding instructions.

- Calculate your total taxable state sales and use tax, then report the results in the respective lines as instructed.

- Proceed to enter state qualifiers for food and general sales, applying the appropriate tax rates as indicated on the form.

- After calculating tax amounts, complete sections regarding regional taxes if applicable. Multiply your taxable amounts by the prescribed rates for Northern Virginia and Hampton Roads.

- Finally, review all entries for accuracy and completeness before proceeding to save, download, print, or share your completed form.

Complete your St 9 Form online today to ensure prompt and accurate tax compliance!

You can easily acquire your Massachusetts Sales and Use Tax Registration Certificate online using the MassTaxConnect website. If you have quetions about the online permit application process, you can contact the Department of Revenue via the sales tax permit hotline or by checking the permit info website .

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.