Loading

Get Form 14457

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 14457 online

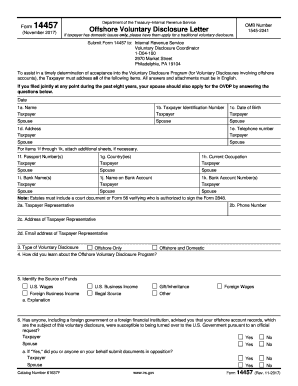

Form 14457 is a crucial document for individuals seeking to enter the Offshore Voluntary Disclosure Program. This guide will assist users in completing the form accurately and efficiently through an online process.

Follow the steps to complete Form 14457 online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by entering the date at the top of the form. Then, fill in your name and taxpayer identification number in sections 1a and 1b respectively.

- In section 1c, record the date of birth for both the taxpayer and their spouse if applicable, followed by the address and telephone numbers in sections 1d and 1e.

- Proceed to sections 1f through 1k to provide details about your passport number, countries of citizenship, current occupations, bank names, account holders, and account numbers. You may attach additional sheets if necessary.

- In section 2, provide your taxpayer representative's name, phone number, address, and email if applicable.

- Select the appropriate type of voluntary disclosure in section 3 – whether offshore only or both offshore and domestic.

- In section 4, indicate how you learned about the Offshore Voluntary Disclosure Program.

- Complete section 5 by identifying the source of your funds and providing any necessary explanations in the space provided.

- Answer the questions in sections 6 through 10 regarding investigations, audits, and your financial status as prompted.

- At the end of the form, read and agree to the certification statement by signing and dating the document. Note that signatures must be original and in blue ink.

- Finally, ensure your form and any attachments are saved correctly. You can then download, print, or share the completed form as needed.

Start completing your Form 14457 online today to ensure your participation in the Offshore Voluntary Disclosure Program.

Related links form

Offshore Penalties Under the updated IRS Voluntary Disclosure procedures the taxpayer does not have a set penalty. Rather, the IRS agent will follow the rules of the IRM (Internal Revenue Manual). Under the IRM, a person is (generally) subject to a 50% penalty on the highest year's unreported balance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.