Loading

Get Payroll Deduction Form (for Non-state Of Ct Employees) Use This Form To Establish Or Modify Payroll

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Payroll Deduction Form (for Non-State Of CT Employees) Use This Form To Establish Or Modify Payroll online

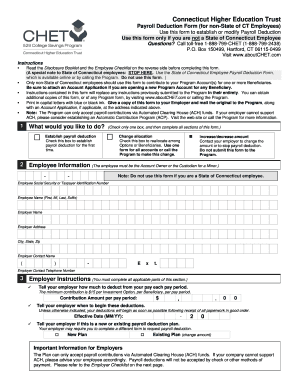

Filling out the Payroll Deduction Form is essential for non-State of Connecticut employees looking to establish or modify their payroll deductions for the Connecticut Higher Education Trust. This guide offers clear instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out your Payroll Deduction Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Read the Disclosure Booklet and the Employee Checklist provided on the reverse side of the form before proceeding. Ensure you understand the requirements and the implications of your choices.

- In section 1, indicate what you would like to do by checking the appropriate box. Choose between establishing payroll deduction for the first time or changing your allocation among options or beneficiaries.

- In section 2, provide your employee information. Fill in your Social Security or Taxpayer Identification Number, name, employer details, and contact information accurately.

- Move to section 3 where you will instruct your employer on the deduction amount. Enter the contribution amount per pay period, ensuring it meets the minimum requirement of $15 per investment option, per beneficiary.

- Specify when your employer should begin the deductions by providing an effective date. Choose whether this is a new or existing payroll deduction plan.

- Proceed to section 4 and provide allocation instructions. Specify how much you want to contribute to each investment option and identify the beneficiaries. Ensure that the total percentage equals 100%.

- In section 5, review and complete the Employee Authorization and Signature. Sign the form exactly as your account is registered and include the date.

- Once you have filled out the form, give a copy to your employer. Mail the original form to the Connecticut Higher Education Trust at the specified address, along with an Account Application if you are opening a new program account.

- Finally, save your changes, and consider downloading or printing a copy of your completed form for your records.

Complete your Payroll Deduction Form online today to manage your contributions efficiently.

Coding CTPL in Box 14 of your W-2 represents funding to support the CT Paid Leave program. Employee payroll deductions beginning January 1, 2022 are capped at 0.5% of the employee's wages up to the 2022 Social Security contribution base of $147,000.00, or $735.00 CTPL taxes paid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.