Loading

Get Sole Proprietor Financial Statement With Calculation Pdf Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sole Proprietor Financial Statement With Calculation Pdf Form online

Filling out the Sole Proprietor Financial Statement With Calculation Pdf Form online can greatly simplify the process of documenting your business finances. This guide will provide you with step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to accurately complete your financial statement online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

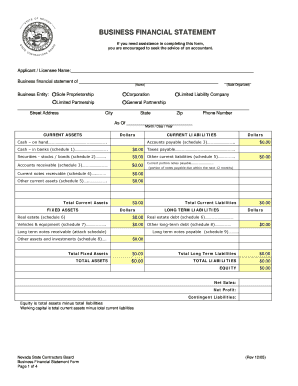

- Enter your name in the 'Applicant / Licensee Name' field and provide the name of your business in the 'Business financial statement of' section.

- Select your business entity type by checking the appropriate box—for example, 'Sole Proprietorship.' Fill in the state where your business is organized.

- Fill in your street address, city, state, and zip code, and provide your phone number. Be sure to note the date this statement is prepared in the 'As Of' section.

- Complete the 'Current Assets' section by detailing your available cash (on hand and in banks), securities, accounts receivable, and other current assets, using the related schedules as necessary.

- In the 'Current Liabilities' section, fill out amounts for accounts payable, taxes payable, and any other current liabilities as provided in the schedules.

- Proceed to fill out the 'Fixed Assets' section, detailing your vehicles, equipment, real estate, and investments, referencing the necessary schedules.

- Next, move to the 'Long Term Liabilities' section, listing any long-term debts under the categories specified.

- Calculate and fill in the total assets, total liabilities, and equity based on the totals provided in the respective sections.

- Complete any supplementary schedules as needed. If there is insufficient space, attach separate sheets for additional details.

- Review all the information for accuracy before proceeding to save, download, print, or share your completed form.

Start filling out your Sole Proprietor Financial Statement online today!

A sole proprietor reports the sole proprietorship income and/or losses and expenses by filling out and filing a Schedule C, along with the standard Form 1040. Your profits and losses are first recorded on a tax form called Schedule C, which is filed along with your 1040.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.